Raise $1-10 Million

“After we changed the vision story, the NOs stopped.”

I’ll turn your raw input into a Billion $ Story, a Tier-1 pitch deck, and a proven system to book meetings and spark FOMO.

2 weeks to build it. 3 months of backup. All 1:1.

Any of these sound familiar?

You thought the meeting went great... and then got ghosted

You’re running out of money. And it’s terrifying.

It feels like there’s a secret VC club — and you’re locked out

One VC says “go broader,” the next says “focus more”

Feels like you’re stuck between stages and no one wants to lead

You start thinking, 'Is it me? Is there an issue?'

You hear “We invest early”… then they ask for traction

You don’t know if your story is good, bad, or just confusing

Your investor pipeline is dry. Your network? Mostly cold.

You’re exhausted — it’s a full-time job on top of running the company.

It hurts when investors don’t get it.

One advisor says pitch now. Another says wait.

If your last fundraise felt like a blur of ghosting, guesswork and grind — I promise there’s a better way.

What you’re actually up against

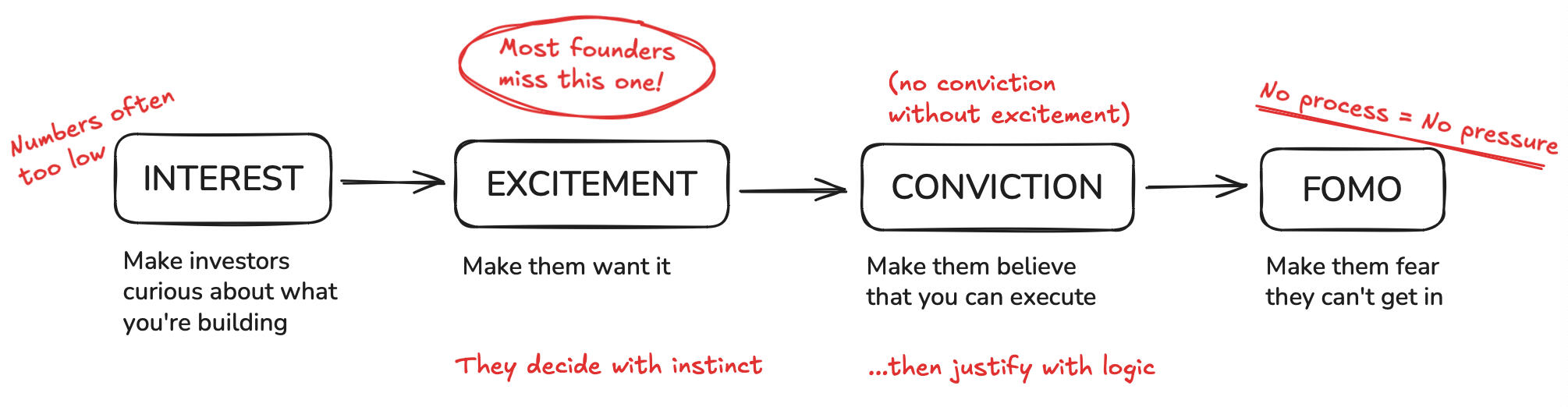

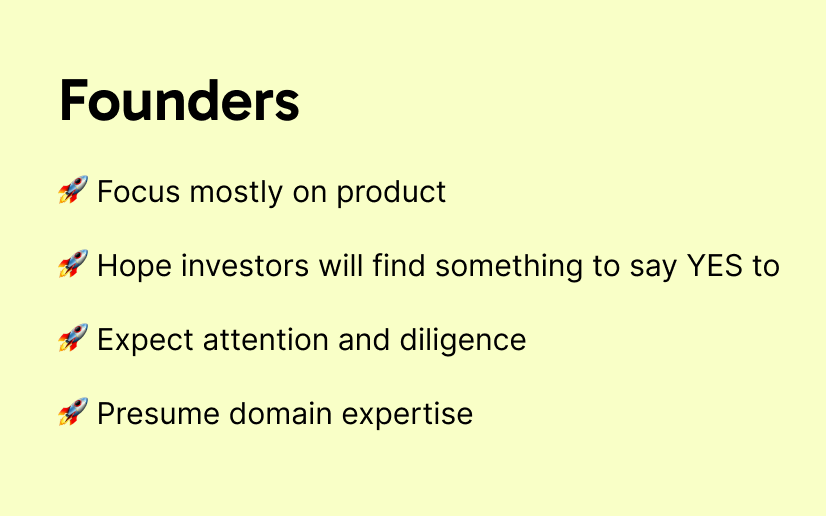

Most founders pitch logic. But investors decide with emotion.

Over the last 11 years I’ve seen ~5,000 startup pitches. And I’ve found that successful fundraising follows 4 steps — 4 emotions that you need to create:

That’s why I created Billion $ Story

Because founders don’t need more advice. They need someone who’s been in the room.I’ve raised money myself. I’ve been the VC across the table. And I’ve worked with over 100 founders, across continents, to shape the stories that actually unlock capital.This work matters to me because I’ve seen brilliant founders get dismissed — not for what they built, but for how they presented it.So I created a system that translates your vision into a story that resonates, without changing who you are or what you believe.

Do you have a Billion $ Story?

Stand out and make VCs believe in your vision even if you’re not from YC or Stanford

Most investors don’t say NO. They just never follow up or give you a weak excuse.Why? Because the story didn’t feel big. Or inevitable. Or exciting. That’s a problem — because investors decide with instinct, then justify with logic.I take your raw notes, your pitch scars, your unfinished thoughts — and shape them into a Billion $ Story that clicks in the room and sticks in their mind. You talk. I write.They won’t ask for the deck. They’ll ask for allocation.

Rewriting slides is not your job

We’ll write and design a Tier-1 pitch deck with only 3 hours of raw input from you

Your deck is on version 11. One investor says simplify. Another says go deeper. Now you’re editing slides instead of growing your business.We rebuild it from scratch — cut the noise, fix the story, and strip out silent deal-breakers. You talk. I write. Then our designer makes it look like it belongs in a partner meeting at Sequoia.You stop tweaking and your calendar starts filling up.

No more rolling the dice

Run a battle-tested process that turns leads into meetings and silence into FOMO

Most founders wing it: cold outreach, chaotic timing, follow-ups based on gut.We replace that with a repeatable process that’s been refined in the trenches by 100+ founders. You’ll know who to hit, how to message and when to press. No magic, just a well-oiled machine.You’ll run the show. Less silence. More calendar invites.I help you become the founder they want to talk to.

BILLION $ STORY

Newsletter

How it works

2 weeks to build. 3 months of backup. All 1:1.

Walk in scattered. Walk out bulletproof.

Prep Week

We dig into your goals, story gaps, past pitch pain and fundraising fundamentals so we hit bootcamp at full speed.

Bootcamp Week

Two calls a day. You give raw input, I extract and create.We build your story, deck, objection handling, elevator pitch and one liner in days — not months.

3 Months Support

You’ve got me riding shotgun while you test and launch.In weekly calls, we revise, adapt, and handle the messy middle. Everything founders usually have to figure out alone.

Book a Fundraise Clarity Call with Uli

Let's chat!

Hey folks,

I'm Uli, founder at Billion $ Story. I spent 6 years as a VC at a $100M firm headed by Google’s Chief Business Officer.Early on, when founders asked me to help them raise, I thought I had it all figured out.- Beautiful deck

- Professional data room

- IB-grade financial modelI did this for 5, maybe 6 startups.

And you know what happened?F*ck all.No call backs. No checks. All I’d done was waste their time and valuable runway.Honestly, it was embarrassing. Because those founders realized what I hadn’t yet:

I had no idea what made VCs invest. Even though I was one.As the saying goes:

You don’t learn to fish from a fish. You learn from a fisherman.So I stopped giving fundraising advice. Quietly. Shamefully.Until one day in London, I sat down with a founder who seemed carelessly unprepared.No deck. No laptop. Just a story about himself and his vision.Halfway into his story, I instinctively thought:“Shit — we gotta to get into this deal.”That was the moment it clicked for me:Investors don’t decide with logic. They decide with instinct — and justify with logic.Investment decisions don’t start in a spreadsheet. They start in the gut.Fundraising isn’t about giving investors complete information. It’s about creating belief.I kept seeing it, again and again, in every founder who raised big.They had what I call a Billion $ Story.A few months after London, I was told I’d make partner soon. The same week, I quit and switched sides.I used what I learned to raise money myself and by now I’ve helped more 100+ founders raise $1-10M with their Billion $ Stories.It took me years to learn what gets signed checks. I’d love to save you that time.So, if you’re raising soon, let’s talk.// Uli

FAQ

Actual answers to actual questions

How do I know if this is right for me?

+

You’re probably here because you’ve tried to raise — and it didn’t land. Or you're about to, and it feels like a black box.Founders come to me when:- Investors don’t get their story

- You feel stuck chasing vs. choosing

- You want to own the room, not just survive it

- You know your story’s missing “something” — but you can’t see itIf that’s you, this is probably a fit.

How do I know if this is NOT right for me?

+

I’m not a fit for you if you …- Want to outsource the fundraise (early-stage is 80% about the founder)

- Not willing to roll up your sleeves (fundraising is time-consuming)

- Aren’t ready to adapt new systems (you will need to)

- Just want to buy intros (see my explanation below)If you’re just looking for a silver bullet, I’m not it.

Do you guarantee that I will raise?

+

I don’t. No one can. And if someone says they do, that’s a red flag.

Do you make investor intros?

+

I don’t. I’m not a placement agent. And I’m not a fan of them.Think about it — How much do you think VCs value intros from paid middlemen?At my VC firm, we wouldn’t even open the deck if it came from one.I help you become the founder they want to talk to.

How much does this cost?

+

Depends.This isn’t a course or some cookie-cutter PDFs. It’s 1:1, in-the-weeds work and it’s a different scope for each startup.Once I understand your situation, I’ll give you a clear quote.A small upfront fee is always part of the deal. So if you’re not in a place to invest anything upfront, then I’m not a fit.

We’ve had bad experiences with consultants before. How are you different?

+

I get it. I’ve been there. Most consultants promise you the world, then give you a playbook and disappear.Not me. I sit with you in the mud. This is 1:1, deep work.I’ve helped 100+ founders raise — not because I have all the answers, but because I’ve made all the mistakes.Happy to send interviews with my clients. Just drop me a line at [email protected]. But in the end, listen to your gut.

How many clients do you work with at a time?

+

I take on max 2 new clients per month and I choose them carefully. I invest a ton of time in each one.That’s how I like to work. I enjoy getting really invested in my clients’ vision.And I didn’t set my business up in a way to funnel hundreds of founders through some generic course.This is personal for me because I’ve been where you are now.

Will this work for me / my business / my industry?

+

I’ve helped B2B and B2C founders raise across:- Industries: AI, SaaS, fintech, medtech, hardware, cybersecurity, DTC,

- Business models: subscription, marketplaces, e-commerce, enterprise, …

- Geos: US, EU, UK, MENA, Asia, LatAm, AustraliaOver the last 11 years I’ve seen ~5,000 startup pitches.I am quick to understand your business and boil it down to what matters in fundraising.

What if our business/product is really complex?

+

In that case you need this even more.The more complex your product, the more you need a story that lands in 60 seconds — not 20 slides. I help you simplify without dumbing it down.

I’m not sure about the optics of hiring help for fundraising. Do people expect me to be great at this already?

+

Running out of money is the #1 reason startups fail.It’s also your job’s least practiced, most opaque part. Getting a sherpa for that climb is smart, not weak.Once you raise, you’ll look like a genius in front of your investors.

How much time do I need to invest?

+

Time you need to invest in our engagement:- About 1-2 hours a day during prep week.

- About 4 hours a day during bootcamp week.

- After, one call a week to adapt and optimize.Time you need to invest in your fundraise:It’s going to feel like a second job on top of your CEO job.So, for the 4-8 weeks in which you take the bulk of your meetings, I recommend having your co-founder take over most of your duties and declining all non-investor meetings you can.The secret is doing it as a condensed sprint. I’ll show you how.

Do you have more case studies or testimonials?

+

Yes. Lots. Drop me a quick line at [email protected] and I them to you.

I have more questions. What do I do?

+

You’ve got questions. I’ve got an inbox and medium-to-excellent typing skills. Hit me up at [email protected].I will absolutely write back — unless you’re a bot, in which case: wow, thanks for reading this far.

What my clients are saying

BILLION $ STORY

Pitch Deck Design for Seed & Series A Founders

Your 13th pitch deck version won’t book meetings. This one will.

Work with an ex-VC whose pitch decks have raised +$135 million. In 2 weeks, you’ll have the story investors actually want to back.

Your raw input → Billion $ Pitch Deck

Sound familiar?

You’re on deck version #11 — and it’s still not working

You're rewriting slides instead of growing your business

One VC says “go broader,” the next says “focus more”

It physically hurts when investors don’t get it.

You’re not being told what’s wrong — just getting more “maybes.”

Every “advisor” says something different. None of it is getting you $$.

Welcome to Pitch Deck Purgatory. It sucks.

Why it's not working

Most pitch decks are way off target

Most decks fail because they don’t match investors’ decision making.

Rewriting slides is not your job

We’ll write and design a Tier-1 pitch deck with only 3 hours of raw input from you

We rebuild it from scratch — cut the noise, fix the story, and strip out silent deal-breakers.You talk. I write. Then our designer makes it look like it belongs in a partner meeting at Sequoia.So you stop tweaking and your calendar starts filling up.

Find out if your deck will make it into the partner meeting or pitch deck purgatory.

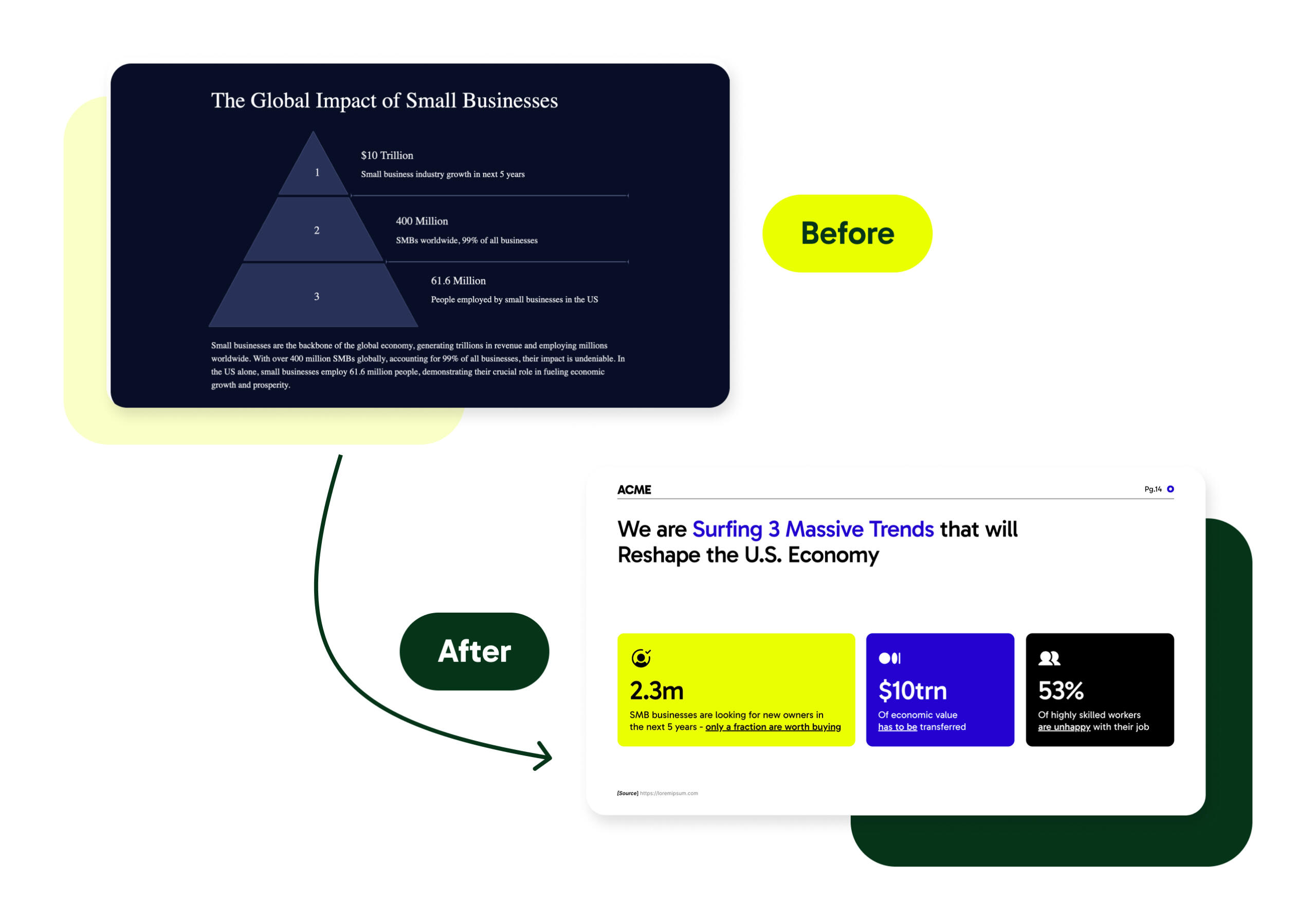

Pitch Deck Transformations

Same founder. Same business.

Different deck. Different outcome.

❌ BEFORE

Corporate look.

Vague headline.

Main point unclear.

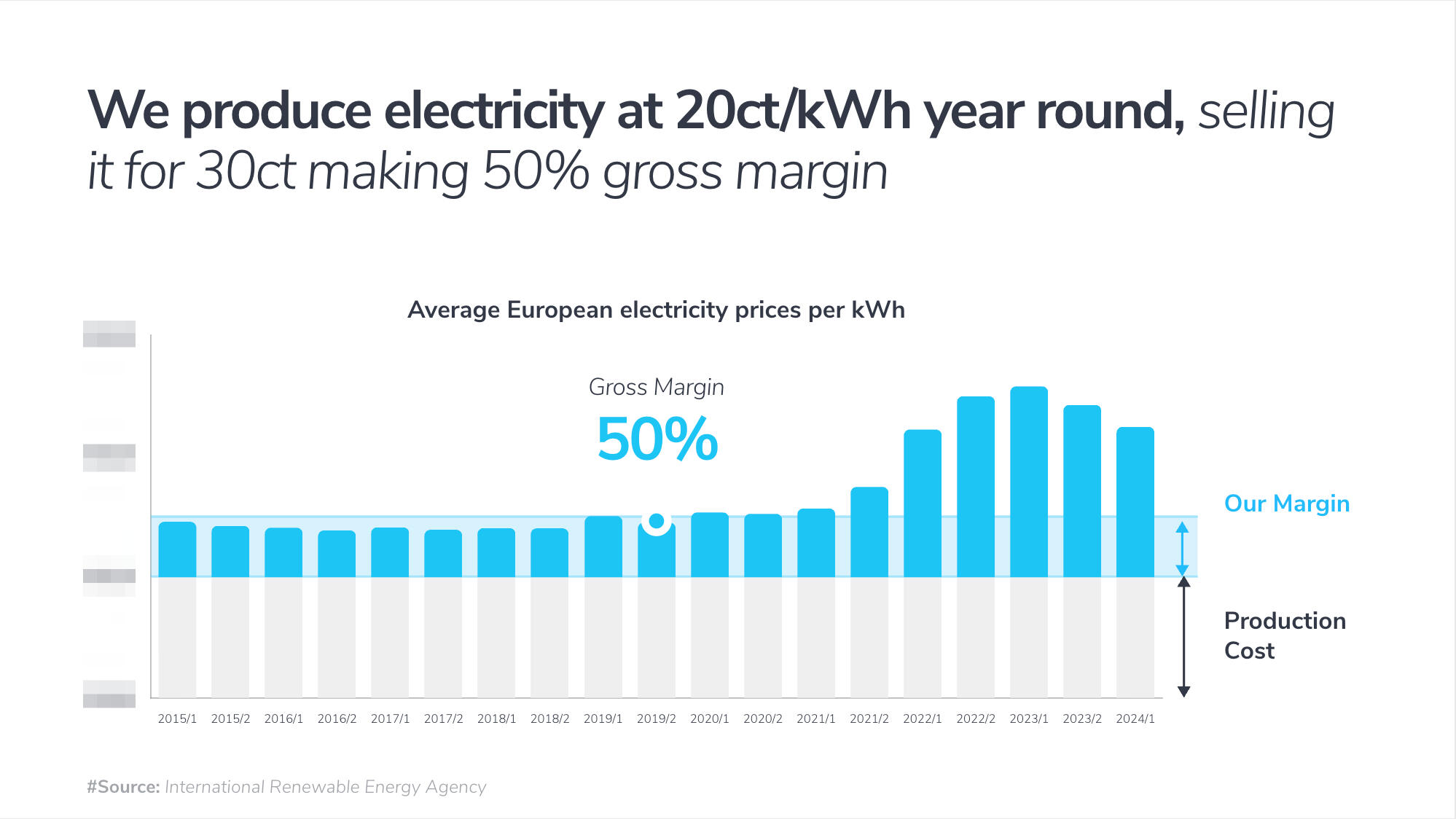

✅ AFTER

Eye-catching.

Copy focused on massive growth opportunity.

Big numbers because humans like those.

❌ BEFORE

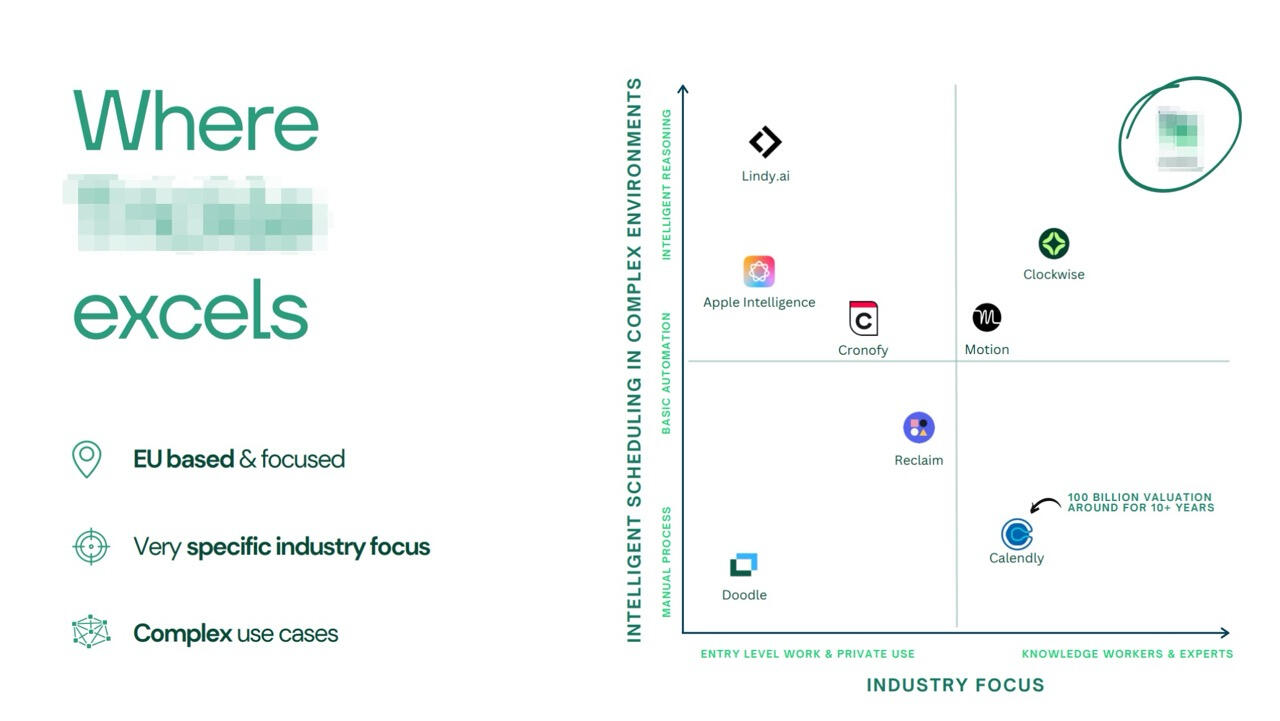

Competitor matrices are played out.

The bullets aren’t impressive/relevant.

Unclear takeaway.

✅ AFTER

World domination slide.

Showcases endless founder ambition (main point) and massive market potential.

Want a transformation like this for your pitch deck?

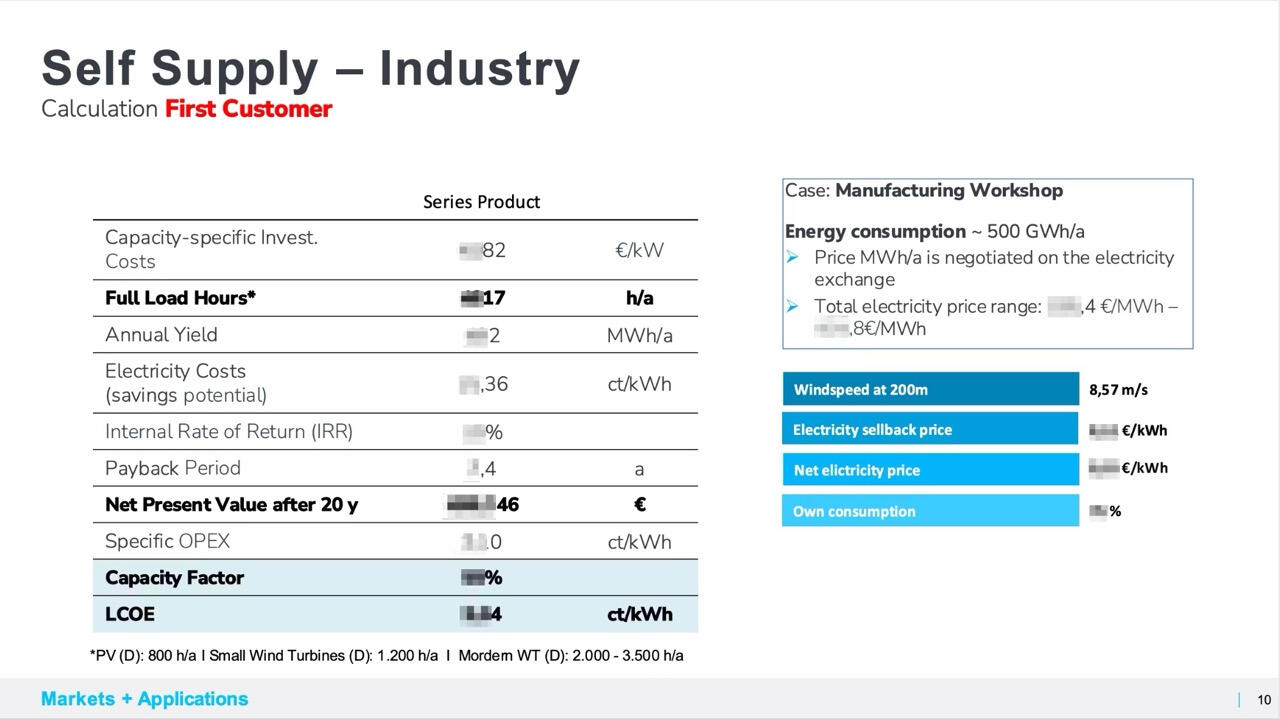

❌ BEFORE

Too many numbers and units.

Tables in decks don’t get read.

Main point unclear.

✅ AFTER

Main point in the headline.

Visual can be understood in <5 seconds.

Showcasing juicy business opportunity.

Hi, I’m Uli 👋

I’ve raised money myself. I’ve been the VC across the table. And I’ve worked with over 100 founders, across continents, creating pitch decks that unlocked +$110 million of capital.I’ve seen more than 5,000 pitches over the last 11 years. And I’ve developed a keen expertise for what makes investors pass and what makes them book a meeting and sign a check.This work matters to me because I’ve seen brilliant founders get dismissed — not for what they built, but for how they presented it.

If you want to find out if I can help you, let’s talk!

Thanks for booking your Fundraise Clarity Call!

Here's what's going to happen next